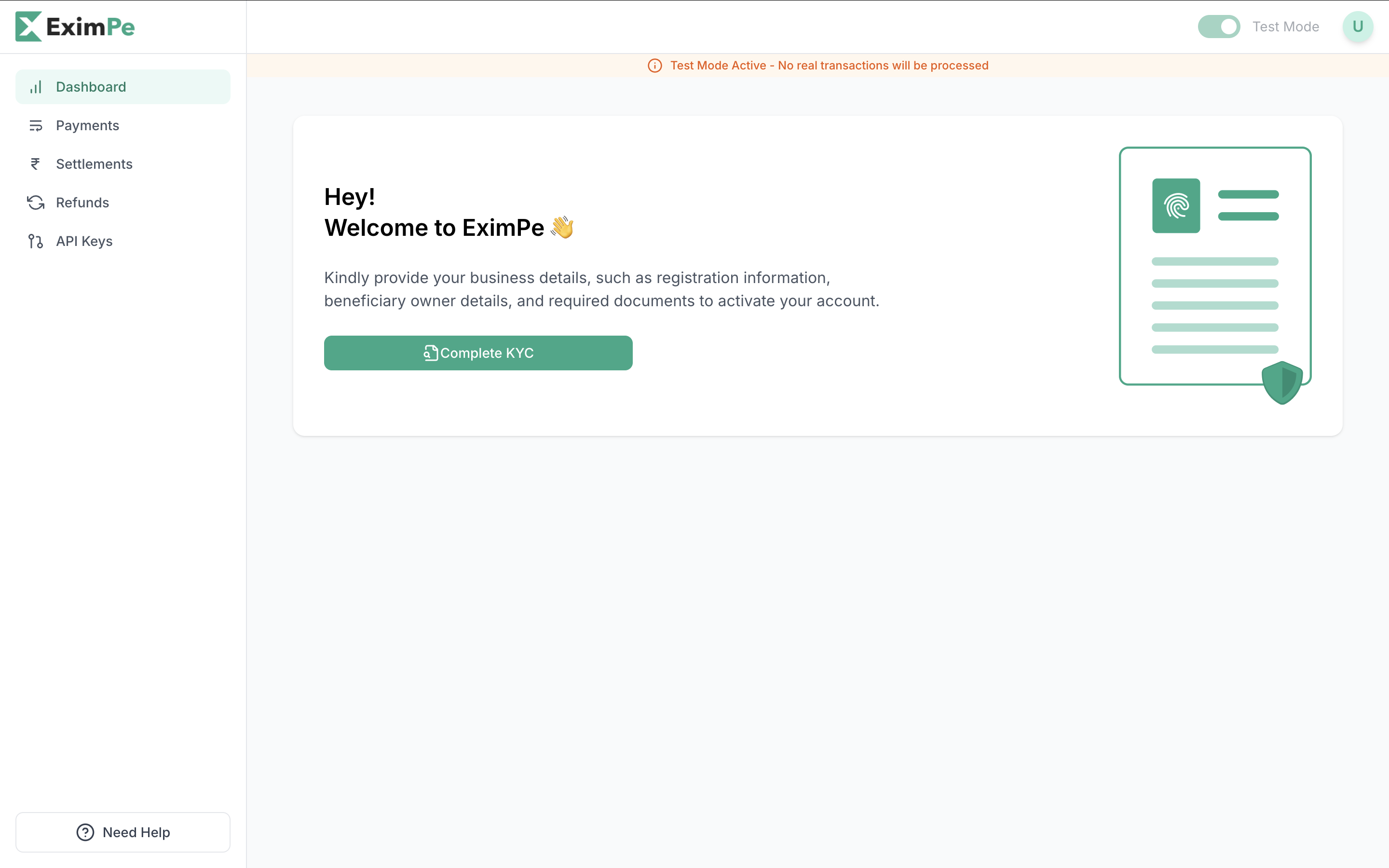

Complete KYC from Your Dashboard

Start the KYC process directly on your EximPe Dashboard. Click on the “Complete KYC” button.

Required Documents

Make sure you have the following details and documents ready: Company Information:- Legal Company Name

- Trade Name (DBA)

- Business Registration Number

- Tax Identification Number

- Organization Type (LLC, Pvt Ltd, etc.)

- Website / App / Store URL

- Average Transaction Value (USD)

- Estimated Monthly Volume (USD)

- This cannot be changed once submitted.

- Full Name

- Email Address

- Phone Number

- Bank Account Number / IBAN

- Bank Name & Branch Address

- SWIFT / BIC Code

- Certificate of Incorporation

- MoA & AoA

- Valid Business Licenses (if applicable)

- Proof of Business Address (e.g., utility bill or bank statement)

- Beneficial Owners’ ID & Address Proof

- Cancelled Cheque or Signed Bank Statement

API Key Access

You get access to API keys right after signing up — but production keys are only available after KYC approval.Sandbox API Keys are available immediately after registration for testing and integration purposes. These simulate transactions without real funds.

Production API Keys are unlocked only after KYC completion and approval. These enable real payments and live operations.

Account Status Lifecycle

| Status | Description | Action Required |

|---|---|---|

| Pending | KYC not yet started or documents missing | Start KYC process |

| Documents Submitted | Documents uploaded – under review | Wait for review |

| Approved | KYC successful – ready for account activation | Account will be activated |

| Active | All set! Your account is live and transacting | Start accepting payments |

| Suspended | Temporarily blocked due to compliance or data issues | Contact support |